The retail landscape is changing more rapidly than ever before. As technology continues to advance, the maturation cycle of each change continues to shorten, while ever-changing consumer and shopper behaviours continue to create new channels and opportunities.

Despite this dynamic new retail environment, many suppliers have yet to adapt to meet the evolving market place. In order to evolve within these market dynamics, we need to understand how and why the consumer market is evolving with such speed.

A quick journey through retail

Originally society traded through bartering. By the 20th century this had evolved into the corner shop where the shop-keeper would pick and pack each item for you and your selection was limited to whatever the Shop-keeper held in stock.

In the 1930’s the ‘open format’ style supermarket radicalised the retail world, by enabling customers to become shoppers. In the 1970’s and the humble barcode was invented and was the first step toward the digital era of retailing.

In the 1990’s the internet was launched, and with it the first online sales (such as Amazon). A new evolution in retailing began.

By 2007 Apple Inc. launched the first smartphone, further accelerating retail development in new and exciting ways, through features we take for granted today like app-based purchases (think Uber Eats), or simply through a website on your phones browser.

In 2018 we shop at the store of our choosing in person or remotely. We compare stores and prices instantly from anywhere and receive product to our door, via click and collect. There is drone delivery, cashless stores such as Amazon Fresh, and technology now enables you to order goods and services as you walk around your home courtesy of Google and Amazon.

So why, in this dynamic and modern era, do suppliers fail to extract value from all these possible new channels that now exist?

Let’s look at an example

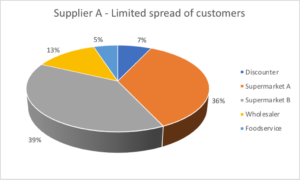

Supplier A is a grocery supplier and deals almost exclusively with the major retailers and wholesalers. Their lack of customer diversification leaves them vulnerable to direct and indirect market pressures.

Supplier A’s split of revenue sees in excess of 80% sitting across just three customers. While exaggerated for illustrative purposes, this is not as far removed from the truth as you might think for many suppliers. Supplier A is constantly at risk of diminishing share and margins, as well as inefficient ranges driving complexity that further increases costs.

So what is a Plan B?

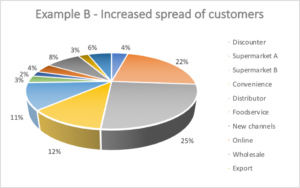

A ‘Plan B’ spreads the burden of performance across multiple channels and customers. It provides the supplier with a greater tolerance for both direct and indirect business pressures.

Enter Supplier B, with its multi-channel strategy.

An multi-channel strategy such as that illustrated in Example B benefits the supplier by providing more options for sales and distribution, more options for shoppers and consumers to access their products, and greater leverage and strength when negotiating with customers.

Is your business vulnerable?

Developing an multi-channel strategy is a logical step for any business serious about evolving in sync with their customer, shopper and consumer base. It is also a fundamental gap in the strategic direction of many suppliers in today’s marketplace.

So as you step back to your work to review your operating plan and possibly start working on bridging performance gaps for this financial year, ask yourself what your channel diversification looks like in your business.